RISC Partners with Orion Fleet Intelligence to Advance Driver Safety and Reduce Claims

Monday, April 1, 2025, 12:00 PM RISC is excited to announce a strategic partnership with Orion Fleet Intelligence, a leader in fleet telematics and driver

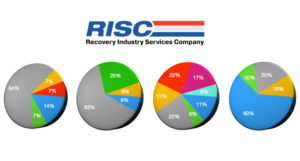

RISC is dedicated to providing compliance solutions for the collateral recovery industry including education, onsite inspections, and vendor vetting services. Whether you are a lender, national forwarder or asset recovery agency, we will deliver comprehensive compliance solutions to fit your needs.

RISC Pro – A Network of the Most Compliant Agencies in the Industry

Monday, April 1, 2025, 12:00 PM RISC is excited to announce a strategic partnership with Orion Fleet Intelligence, a leader in fleet telematics and driver

Marketing your repossession agency is not necessarily a straightforward endeavor. Repossession agencies do not market themselves like a typical local business nor are all marketing

by Holly Balogh : RISC / President Insurance coverage requirements vary significantly from one creditor to the next. Although the insurance industry provides coverage in